Why is CPPIB's MER higher than its peers?

Remember than Grade 4 math trick? The one where you were to tell your parents that you’d gladly accept a reduction in your weekly allowance to a penny, provided that it doubled each week after that? I recall that I’d have been very rich before leaving the Bloor West Village for Western, if I hadn’t bankrupted my folks first.

That’s the thing about small figures. They can really add up.

Which is sorta what’s been happening over at the CPP Investment Board. The “pennies” are growing exponentially, but, unfortunately, not the ones destined for our pockets.

Reminds me of the moment in Bonfire of the Vanities, when Judy McCoy describes her husband’s job to their daughter Campbell:

Just imagine that a bond is a slice of cake, and you didn’t bake the cake, but every time you had somebody a slice of the cake a tiny little bit comes off, like a little crumb, and you can keep that. […] If you pass around enough slices of cake, then pretty soon you have enough crumbs to make a gigantic cake.

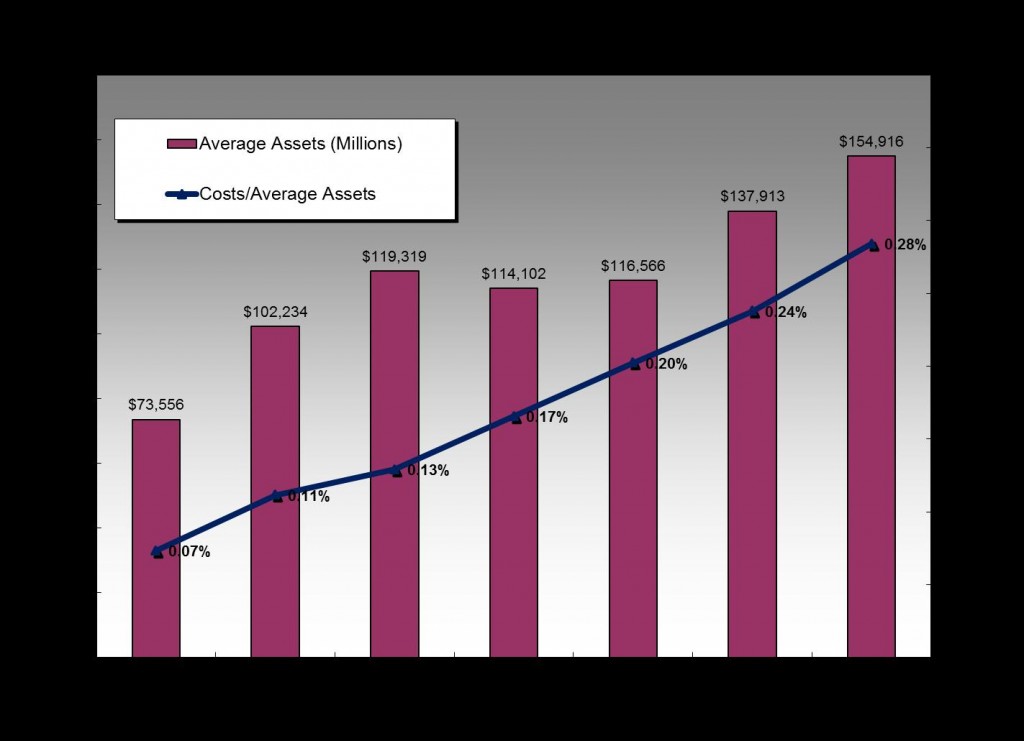

In 2006, the CPPIB spent $54 million on salaries and staff pension contributions ($26M), general and administrative costs ($21M), and professional fees ($7M). With $73.6 billion of average assets under management that year, our Management Expense Ratio was 0.07%.

Sounds truly cheap, doesn’t it?

In two year’s time, the MER doubled to 0.13%, as average assets grew to $119.3 billion and our SG&A tripled to $154 million as the not-so-new management team of CEO David Denison and then-EVP Mark Wiseman settled into their roles.

For the 2012 fiscal year, our CPPIB MER was up four fold to 0.28%, with $440 million of internal overhead managing $154.9 billion of average net assets (as Susan McArthur of Jacob Securities outlined on BNN last month). During the final five full years of David Denison’s tenure, annual internal management costs had grown 286%, and $1.347 billion in aggregate was spent between 2008-2012 on overhead — all to achieve an annualized total return of 2.2% — well below the 4% plus inflation target required to keep the plan solvent.

As a percentage of net income generated in that fiscal year, internal management costs went from 0.44% in 2006 to 4.63% in 2012. Guess folks aren’t getting paid based upon the profit that they’re actually generating, either.

And let’s not forget that “net income” in this case is just a guess under GAAP, since a majority of the CPPIB’s assets are of a “Level 3” nature, which means there’s no quote to price them off of.

CPPIB will say that the huge change in expense ratio was a function of the growth in the active side of the mandate post-2005, which required a hiring binge and the systems needed to support more than 1,000 new staff. It is true that the external private equity portfolio grew from $5 billion to ~$30 billion by 2009, for example, but how many people do you really need to hire to watch over the teams at firms such as KKR, TPG and Blackstone? Whether it be Mark Weisdorf, John Breen or Mark Wiseman, none of them can adjust for the tumult in the global LBO market.

Let’s accept that, for a moment, every team member was necessary given the CPPIB’s desire to directly invest in toll roads, airports and tech companies. I can think of a few other large pension plans with equally active mandates, such as Ontario Teachers, OMERS and the HOOPP.

Last time I checked (see prior post “Does Ontario really need five Pension Plans?” Nov 24-11), Ontario Teachers’ MER was a modest 0.20%-0.21%, and the HOOPP was getting by with 0.18%-0.22% of their gross assets under management. On a gross asset basis, CPPIB’s MER drops to about 0.25% from 0.28%, which means it still would cost the CPPIB $60-70 million more internally than the Teachers to manage the same asset pool.

Moreover, with $30 billion of external private equity commitments, unlike HOOPP and OTTPP which limit the use of external PE managers as much as they can, CPPIB is paying external management fees of between 1-1.5% per annum there too. Another $300 million to $450 million in fees and expenses to manage that pile of dough (according to CPPIB’s annual report, they paid $650 million in total external management fees in 2012), pushing our comparable MER closer to 0.55%, dramatically higher than OMERS’s figure of 0.45-0.47%.

As HOOPP CEO, John Crocker told the Globe’s Boyd Erman in response to my 2011 blog (see prior post “Does Ontario really need five Pension Plans? part 2” Dec. 15-11):

“our CIO Jim Keohane notes that once a fund grows beyond $75 billion in assets the real risk is diseconomies of scale as costs can actually start to go up.”

What happens when the CPPIB hits $750 billion in assets, as forecast? Will we be paying 1% a year in total overhead by then?

MRM

Recent Comments