CPP Investment Board FAQ answer mirrors that of New Plymouth, New Zealand Investment Manager report

Does anyone else care about this stuff?

Given all of the excitement around the world these days about the importance of avoiding even the appearance of plagiarism (see representative prior posts “Why is “cut and paste” ever allowed in the newsroom?” Oct. 22-12, “Plagiarism. Imitation. Sloppiness. Sadly, nothing new.” Sept. 25-12, and “Hunger Strike – Day 11” June 26-10), it is remarkable to still trip across two documents that use exactly the same phrase. If you love words, you know what I mean.

Despite spending more than $440 million annually to run the Canada Pension Plan Investment Board (see prior post “Why is CPPIB’s MER higher than its peers?” Jan. 9-13), plus another $300 million + a year on external management fees, even the CPPIB website shares lingo that can be found elsewhere in the world of public investing.

Here’s what I mean:

CPPIB “Frequently Asked Questions” website page FAQ #7:

7. What rate of return is necessary to maintain the sustainability of the Canada Pension Plan for generations to come?

The CPP, which was successfully reformed in 1996–1997, is sustainable.

According to the Chief Actuary in his most recent triennial report released in November 2010, the CPP Fund needs a real rate of return – that’s return after inflation – of 4.0 per cent, over the 75-year projection period in his report, to help sustain the plan at the current contribution rate.

Our nominal 10-year return of 6.7% is now above the 4.0% after-inflation return currently used by the Chief Actuary of Canada in confirming the sustainability of the Canada Pension Plan.

These returns should be viewed in the context of the overall performance of major global financial markets. Our 10-year returns took place during the worst decade of equity performance in the more than 200 years of recorded capital market history.

Given our long-term view, we remain confident that we will meet and exceed the 4.0% rate of return over the 75-year period of the Chief Actuary’s projection.

For those of you with a nose for language, you might find it interesting that the New Plymouth District Council’s “Management of Investments and Funding” webpage, appears to have posted the same phrase on Aug. 11, 2012 as part of their explanation for the returns they’d been experiencing in the stock market:

Despite the market volatility we have witnessed in recent years, TIML remain confident that our investment strategy will deliver the expected returns required for the long term sustainability of the PIF for decades and generations to come.

The PIF asset allocation and strategy is designed for a long term investment horizon and has a multi generational perpetual mandate.

The PIF therefore focuses on returns since inception and has had an annualized return of +5.73% per annum or +$137.41m of investment income over that term.

These returns should also be viewed in the context of the overall performance of major global financial markets in the short and long term. The PIF returns since inception have taken place during the worst decade of equity performance in the more than 200 years of recorded capital market history.

Whether one plagiarized the other, or both independently arrived at the exact same lingo I don’t know. Perhaps members of both teams attended the same conference on investor relations and heard a presentation from Yale University finance professor William Goetzmann. CPPIB had that phrase on its site as of November 28, 2012, but there’s no website “updated as at” details posted so as to know when the CPPIB FAQ in question was originally created.

What I find almost as interesting is that there even is such a thing as “200 years of recorded capital market history”. I know that many books have been written on the subject, but didn’t appreciate that there had been a reliable, continual index to track for such an extended period. Without the Dow or S&P 500, how could we know that the last ten years WERE the worst decade of the past 200 years?

The Wall Street Journal referred to it this way in 2009, I see, according to the elliottwave.com website:

Here are the three key items from the Wall Street Journal article:

•”In nearly 200 years of recorded stock-market history, no calendar decade has seen such a dismal performance as the 2000s.”

•”With two weeks to go in 2009, the declines since the end of 1999 make the last 10 years the worst calendar decade for stocks going back to the 1820s, when reliable stock market records begin, according to data compiled by Yale University finance professor William Goetzmann.”

But is this even true? Unless you were overexposed to the NASDAQ, mind you. Which wasn’t something that would have fit with founding CPPIB CEO John MacNaughton’s investing prudence. I have a faint recollection that he even sought permission from Ottawa to allow the CPPIB to go underweight certain index stocks in the early part of the decade due to the huge, risky component that Nortel had become within the TSX 300.

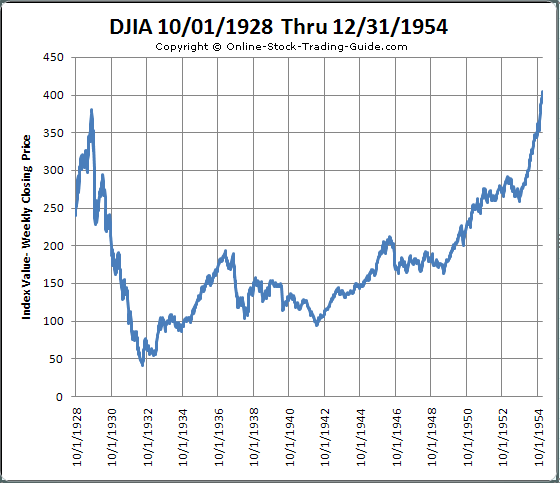

Between Jan. 1, 2000 and Dec. 31, 2009, the Dow Jones fell by 9.5% according to my Yahoo! Finance chart. Google Finance says the drop was about 10%. According to the following chart, the Dow fell far more than 10% from Jan. 1930 to Dec. 31, 1939:

Even the Faceless Gods at Wikipedia seem to know that the “Dow closed at 381.17 on September 3, 1929. [And then entered a Bear Market from 1929-1949:] The stock market crash of 1929 precedes the Great Depression. The Dow plunges to 41.22 (theoretical intra-day low of 40.56) on July 8, 1932, thus erasing 36 years of gains. Although cyclical bull markets occur in the 1930s and 1940s, the index would take 22 years to surpass its previous highs.”

The NASDAQ had a terrible go post Jan. 2000, so perhaps that’s a driver of the Goetzmann analysis.

But, if the Dow fell from perhaps 250 points at the start of January 1930 to around 135 points at the end of the decade, for a drop of ~46%, why is it that CPPIB says their recent “10-year returns took place during the worst decade of equity performance in the more than 200 years of recorded capital market history”? The Dow fell 10% while the S&P 500 dropped 24.96% from 2000-2009. I can’t find another fund in the world that relies on that excuse.

Never mind who the authour was. The last decade doesn’t seem to have been nearly as bad as they claim.

MRM

(disclosure: this post, like all blogs, is an Opinion Piece)

Recent Comments