Comparing Growth Capital to amortizing Venture Debt

For more than 15 years, our firm has been providing non-amortizing growth capital to innovation companies. The financing structure was unique to the sector when we first introduced it; as far as we were concerned, CFOs would prefer to keep the money they raised for growth, rather than repaying their lender on a monthly basis.

During that 15+ year period, we’ve spent a great deal of time talking through the mechanics of Growth Capital as well as traditional amortizing venture debt with CFOs from Canada, the United States and, more recently, the UK.

When we got started, traditional venture debt from firms such as MMVP came in the form of a 36 month amortizing loan. Ron Dizy, then a Partner at VC firm Celtic House, once told a conference that such a form of capital “extends the runway by only 2.5 months.” By 2004, our then-competitors made such adjustments to their business model, and you’d see a six month principal holiday followed by a 36 month straight-line amortization period. That principal amortization “holiday” would grow to 9 months, and then 12 months.

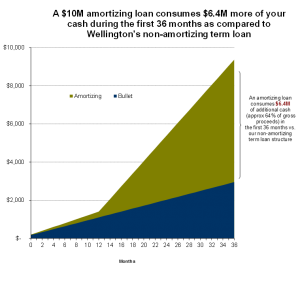

We still run up against venture debt funds and banks that have tabled term sheets featuring a 48 month amortizing loan (12 month holiday, 36 month amortization) with great regularity. Often, the cost of such capital is perceived to be lower than what we offer, and CFOs will ask us how they should compare these products to our 5 year non-amortizing growth capital structure. I thought it would be useful to share that with all of you.

The key difference is how much useful capital is available to the company in question, and over what time period.

With a 48 month product, with a 12 month holiday, the company winds up paying half of the original loan back over the first 2 years, between the interest rate, closing fee and principal amortization charged by our competitors.

As such, with the majority of the lender’s capital repaid over the first 2 years, they can charge a bit less given the dramatically reduced risk they’ve taken when compared to our 5 year non-amortizing term loan structure.

That doesn’t mean the capital is truly cheaper from an actual cash standpoint,: if you were to raise $10 million from our firm, the reality is that you’d need to raise $16 million via the 48 month product to have the same availability of capital after 2 years.

That’s the key analysis to consider: how much capital is available to grow your business, and when is it available? The covenants will always be different between firms, and your business will perform as it will perform. Whether or not a covenant trips will play out over time, and if it does, that will be a function of your customers, your competitors, the general marketplace, the execution of your sales and development teams, and so forth. Even when a lender says they offer “no covenant” loans, you can be sure they tell their Limited Partners / Investors that embedded in their loan agreement are plenty of protections should a company not meet revenue and burn expectations. As for banks and their “no covenant” deals, they mean no covenant, except for a Material Adverse Change clause, of course. The FDIC wouldn’t have it any other way.

None of these things can be controlled by a growth company looking to raise capital.

The one thing you can control is how much capital will be available under these various structures down the road. That’s our true value-add, whether you miss your forecast or hit them. And it has been demonstrated in the success of many VC-backed companies over the past 18 months, including Bluestreak (M&A), CrownPeak (M&A), Invision (M&A), Marketlive (M&A), Maxymiser (M&A), Phd Virtual (M&A), Softgate (M&A), Xactly (NYSE IPO)….

MRM

Recent Comments